| Check the appropriate box: | ||||||||

| ☐ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

| ☒ | No fee required. | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

Stockholders and Proxy Statement

8, 2024

NEO2024.

NeoGenomics, Inc.

Lynn Tetrault

| Lynn Tetrault | ||

| Non-Executive Chair of the Board of Directors | ||

Notice of 2023 Annual Meeting of Stockholders

1. To elect eightnine directors from the nominees named in the attached Proxy Statement.

Fourth Amendment of the Employee Stock Purchase Plan (as amended and restated).

2024.

25, 2024.

|  |  | ||||||

| By Mail | By Phone | By Internet | ||||||

& Business Development

Index of Frequently Requested Information

2023

This Proxy Statement, including the notice of the 2024 Annual Meeting (the "Meeting Notice") and the proxy card, were first distributed to our stockholders on or about April 8, 2024.

1

| Proposal 1 - Election of Directors | ||||||||||||||

•As of March •Our Director nominees are diverse. •All |  | The Board recommends a vote FOR each Director nominee.

| ||||||||||||

| à | ||||||||||||||

| Proposal 2 - Advisory Vote on Executive Compensation | ||||||||||||||

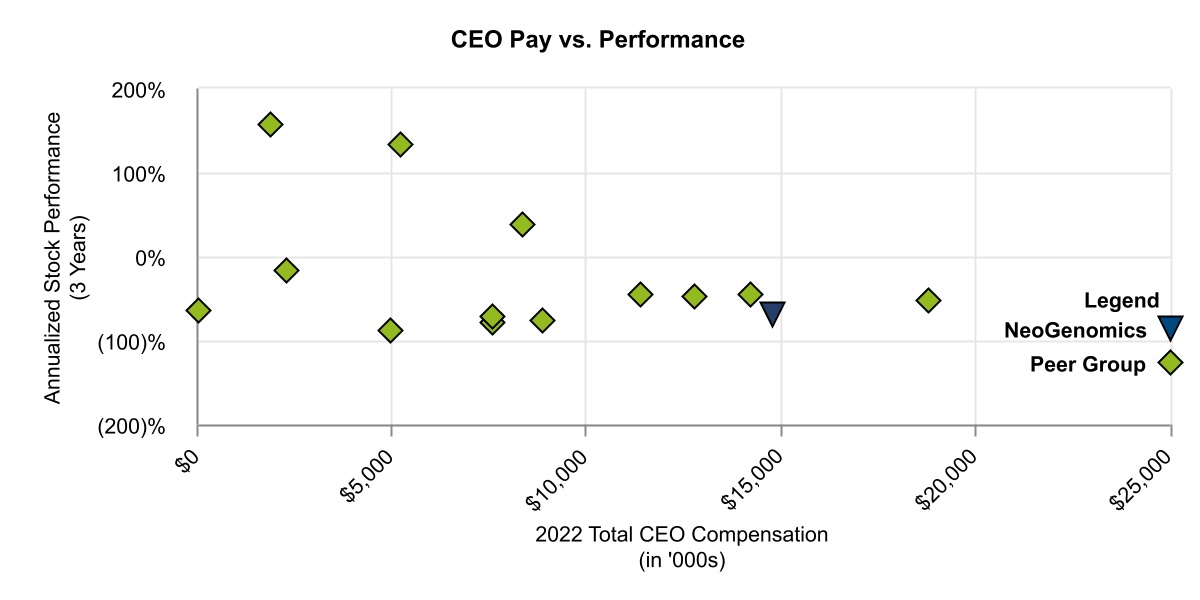

•We strive for pay-for-performance and believe that performance objectives should align with our strategy over the long term. •Our compensation philosophy is focused on providing compensation and benefits that are competitive and meet our goals of attracting, retaining, and motivating highly skilled teammates and management. | ü |

| ||||||||||||

| à | ||||||||||||||

Proposal 3 - To Approve the

| ||||||||||||||

•To approve the | ü |

| ||||||||||||

| à | ||||||||||||||

| Proposal 4 - Ratification of Independent Registered Accounting Firm | ||||||||||||||

•The Audit and Finance Committee of the Board has appointed Deloitte & Touche LLP to act as our independent registered public accounting firm for the fiscal year ending December 31, |  | The Board recommends a vote FOR this proposal.

| ||||||||||||

| à | ||||||||||||||

| NeoGenomics, Inc. | 1 | 2024 Proxy Statement | ||||||

Corporate Governance

2

We recognize that the Board’s role and oversight extends to sustainability, human capital management, and environmental impact. We continue to have meaningful internal and external conversations about environmental, social, and governance (“ESG”) policies and initiatives and are increasing our focus on related efforts. We believe that progress on these objectives aligns with our vision and further supports our progress towards our near and long-term strategic objectives.

| Diversity, Equity, Inclusion & Belonging Vision | ||||||||||||||||||||

| ||||||||||||||||||||

|

3

We also encourage and support community involvement and corporate philanthropy. As part of our social wellness program, we partner with VolunteerMatch Virtual Volunteer Opportunities and with Project Helping, a mental wellness organization that creates meaningful social and accessible volunteer experience to help people improve their mental wellness through service. Each year we also provide corporate giving to organizations that are aligned with our purposes and values. During 2022 we made a variety of charitable donations, education grants, sponsorship programs, and research grants. In September 2022, Hurricane Ian devastated the town of Fort Myers, Florida, where our Company’s headquarters is located. In response, the Company assisted with cleanup efforts and created a fund to provide financial assistance to employees affected by the storm with remaining funds being donated to the American Red Cross. The totals donated to NeoGenomics’ employees and The American Red Cross were approximately $55,000 and $200,000, respectively.

| NeoGenomics, Inc. | 2 | 2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

| NeoGREEN Vision | ||||||||||||||||||||

| NeoGenomics is committed to seeking and upholding environmentally sustainable solutions that build trust with our employees, clients, and stakeholders. | ||||||||||||||||||||

4

| Corporate Governance Highlights | |||||

| Independent Board Chair | •As of March | ||||

| Independent and diverse director nominees | •As of March •All Board committees are entirely comprised of independent directors •Five of our •Directors have a broad range of experience, skills, and qualifications (see | ||||

Executive sessions of

| •Independent directors meet regularly without management | ||||

| Active board refreshment | •Balanced mix of short and long-tenured directors • twenty-four months •Annual election of all directors | ||||

| Continual assessments | •Board and Committees complete annual self-evaluation surveys •Annual Chief Executive Officer and executive management performance and potential evaluation in alignment with corporate goals and objectives, including achievement of business and strategic objectives •Continuously evaluate director capacity | ||||

| Stock ownership guidelines | •No hedging or pledging of NeoGenomics stock •Minimum stock holding requirements for directors and executive officers | ||||

| NeoGenomics, Inc. | 3 | 2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

| Role | Share Ownership Guideline | Current Share Ownership | ||||||||||||

| Chair of the Board | 3.0 | 13.5 | ||||||||||||

Board Members(1) | 3.0 | 15.6 | ||||||||||||

5

Generally, when evaluating and recommending candidates for election to the Board, the Nominating and Governance Committee will conduct candidate interviews, evaluate biographical information and background material, and assess the skills and experience of candidates against selection criteria set forth in the Strategic Competencies Matrix in the context of the then-current needs of the Company. In identifying potential director candidates, the Board may also seek input from the executive officers and may also consider recommendations by employees, community leaders, business contacts, third-party search firms, and any other sources deemed appropriate by the Nominating and Governance Committee. The Nominating and Governance Committee will also consider director candidates recommended by stockholders to stand for election at the annual meeting of stockholders so long as such recommendations are submitted in accordance with the procedures described below under “Stockholder “Stockholder Recommendations for Board Candidates.””

On July 15, 2020, Ms. Lynn Tetrault was appointed Lead Independent Director. On October 7, 2021, Ms. Tetrault was appointed as non-executive Chair Under our current leadership structure, the roles of the Board. Effective March 28, 2022, in connection with Mr. Mallon’s termination as Chief Executive Officer and resignation from the Board, Ms. Tetrault was appointed Executive Chair of the Board and as such functioned as the Company’s principal executive officer. Effective May 12, 2022, Ms. Tetrault was appointed Interim Chief Executive Officer and continued in her role as Chair of the Board. Effective August 15, 2022, upon the appointment of Mr. Smith as Chief Executive Officer, Ms. Tetrault resumed the position of non-executive Chair of the Board. Mr. Michael Kelly, an independent director on the Board for the duration of 2022, served as the Board’s Lead Independent Director for the duration of Ms. Tetrault’s service as Executiveare held by two different individuals. The board's independence from management is increased by having separate Chair of the Board and Interim Chief Executive Officer in 2022.

roles, which helps lead to better monitoring and oversight.

| NeoGenomics, Inc. | 4 | 2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

6

| NeoGenomics, Inc. | 5 | 2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

| Board of Directors | ||||||||||||||||||||

•Stay informed of our risk profile and oversee our Enterprise Risk Management program •Consider risk in connection with strategic planning and other matters | ||||||||||||||||||||

Audit & Finance | Nominating & Corporate Governance | Culture & Compensation | Compliance | |||||||||||||||||||||||||||||

•Enterprise risks, including but not limited to risks relating to IT use and protection, data governance, privacy, and cybersecurity •Independent auditor’s qualifications and independence •Financial reporting and processes, including | • •Investor engagement and communications •Review Board size, composition, function, duties, diversity, and Strategic Competencies •Develop and recommend to the Board the Corporate Governance Guidelines and oversee compliance with | •Review the risks associated with the •Oversee an annual review of the •Diversity, equity, inclusion •Succession planning | •Assess management’s implementation of the Corporate Compliance Program elements •Assess adequacy and effectiveness of policies and programs to monitor compliance with laws and regulations •Monitor significant external and internal investigations •Implementation of Code of Business Conduct and Ethics •Confirmation of zero conflict of interests related to members of the Board of | •

•Support recruitment and interactions with

| ||||||||||||||||||||||||||||

| NeoGenomics Management | ||

| NeoGenomics | ||

these risks. | ||

| NeoGenomics, Inc. | 6 | 2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

7

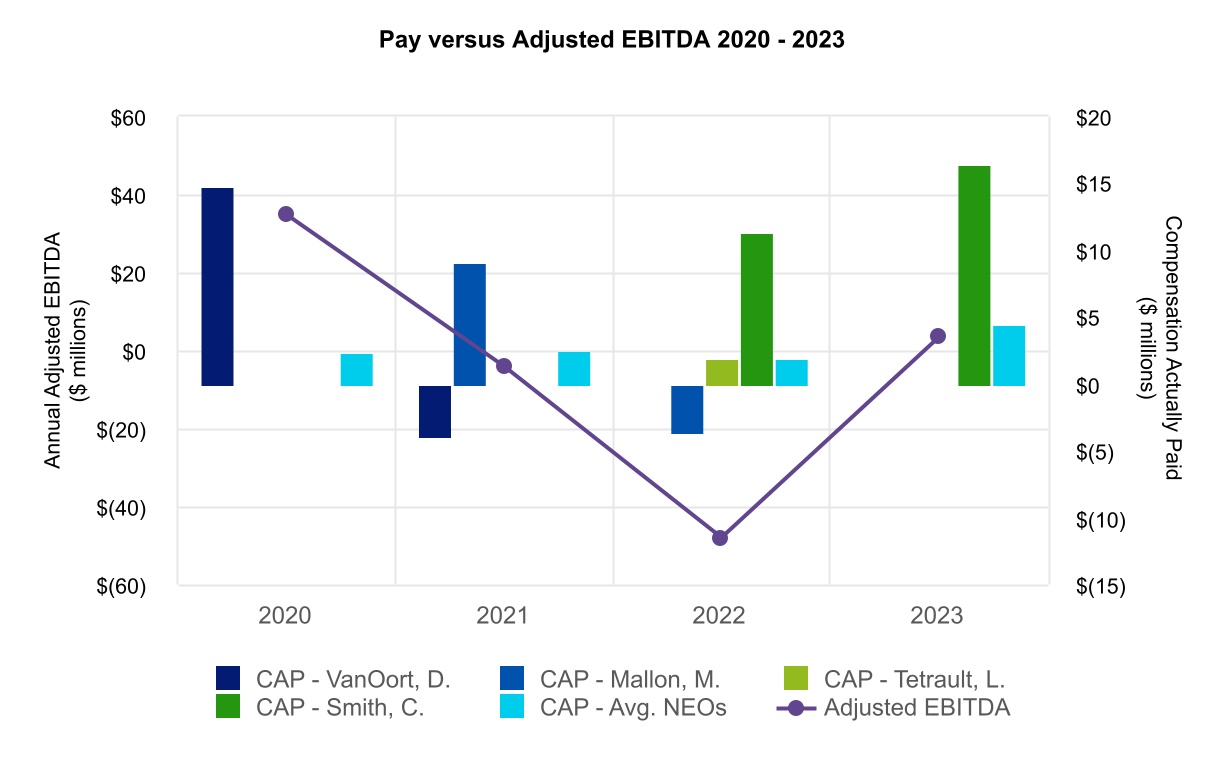

In 2022,2023, we received approximately 31%52% support for our annual say-on-pay proposal. Following our say-on-pay vote in 2022,2023, we widened our governance outreach and engagement even further to ensure we understood stockholders’ concerns and to inform and guide our actions in response. WeAs evidenced by the actions taken already throughout 2023, we take the outcome of this vote seriously and have been highly focused on understanding and responding to our stockholders’ feedback reflected in this vote.feedback. Through the company’sCompany’s engagement efforts, the committeeCulture and Compensation Committee sought to elicit and consider a full range of stockholders’ perspectives related to NeoGenomics’ executive compensation program programand design elements and ESG initiatives to inform specific actions to informand appropriate responses to the say-on-pay vote.

throughout 2024.

8

| NeoGenomics, Inc. | 7 | 2024 Proxy Statement | ||||||

| Lynn Tetrault | Age: 61 | Non-Executive Chair of the Board | ||||||||||||||||||||

Lynn Tetrault has served as the non-executive Chair of the Board since August 2022. Prior to her holding this position, from May 2022, Ms. Tetrault served as our Interim Chief Executive Officer and Chair of the Board. From March 2022 to May 2022, Ms. Tetrault served as our Executive Chair of the Board and functioned as the Company's principal executive officer. From October 2021 to March 2022, she served as our non-executive Chair and from July 2020 to October 2021 she served as our Lead Independent Director. Ms. Tetrault has been a director since June 2015. She has also served as a director of Rhythm Pharmaceuticals, Inc. since 2020 and as a director of Acelyrin, Inc. since December 2023. Ms. Tetrault has more than 30 years of experience in the healthcare sector. She worked from 1993 to 2014 with AstraZeneca PLC, most recently as Executive Vice President of Human Resources and Corporate Affairs from 2007 to 2014. Ms. Tetrault was responsible for human resources strategy, talent management, executive compensation and related activities, internal and external communications, government affairs, corporate reputation, and corporate social responsibility for AstraZeneca. Prior to AstraZeneca Ms. Tetrault practiced healthcare and corporate law at Choate, Hall and Stewart in Boston. Ms. Tetrault has a BA from Princeton University and a JD from the University of Virginia Law School. Skills and Qualifications Lynn Tetrault is a dynamic, seasoned executive in the pharmaceutical industry. Having progressed through numerous senior management roles at AstraZeneca, she acquired extensive human resource and corporate governance experience at the highest level of that company. As the Company continues to grow, Ms. Tetrault’s experience is helping to shape human resource policies and operations as well as the make-up of the Board and its governance policies, and therefore we believe that Ms. Tetrault is well qualified to serve on our Board. | ||||||||||||||||||||

| Christopher Smith | Age: 61 | Board Member and Chief Executive Officer | ||||||||||||||||||||

Chris Smith was appointed Chief Executive Officer and a director in August 2022. Prior to joining NeoGenomics, from 2019 to 2022, Mr. Smith served as Chief Executive Officer of Ortho Clinical Diagnostics (“Ortho Clinical”). Under his leadership, Ortho Clinical raised $1.45 billion in funding for a 2021 initial public offering and achieved accelerated revenue growth while simultaneously improving profitability. Mr. Smith successfully guided the company through a combination with Quidel that closed in May 2022. Prior to Ortho Clinical, from 2004 to 2018, Mr. Smith served in key executive leadership positions, including CEO of Cochlear Limited (“Cochlear”), a global market leader in implantable hearing solutions. Having initially joined Cochlear as President of Cochlear Americas in 2004, Mr. Smith helped grow division revenue from $80 million to over $400 million before being named CEO in 2015. Before joining Cochlear, Mr. Smith served as a Chief Executive Officer in residence at global private equity firm Warburg Pincus and Global Group President at Gyrus Group Plc., a surgical products company. Prior to that he served in a variety of leadership roles at Abbott, KCI, Prism and Cardinal Health. Prior to 2023, Mr. Smith has served as a member of the board of directors at QuidelOrtho, a global provider of innovative in vitro diagnostic technologies, Akouos, Inc., Osler Diagnostics Limited and Results Physiotherapy. In addition, since mid-2023, Mr. Smith has served as a member of the board of directors of Laborie Medical Technologies Corp. Mr. Smith has a BS from Texas A&M University. Skills and Qualifications Mr. Smith is a dynamic leader with strong cultural values, vast diagnostic industry experience, and an extensive history of proven operating success. Because of Mr. Smith’s extensive industry knowledge and his experience serving on the boards of directors of other public companies, we believe Mr. Smith is well qualified to serve on our Board. | ||||||||||||||||||||

Skills and Qualifications: Ms. Tetrault is a dynamic, seasoned executive in the pharmaceutical industry. Having progressed through numerous senior management roles at AstraZeneca, she acquired extensive human resource and corporate governance experience at the highest level of that company. As the Company continues to grow, Ms. Tetrault’s experience is helping to shape human resource policies and operations as well as the make-up of the Board and its governance policies, and therefore we believe that Ms. Tetrault is well qualified to serve on our Board.

Christopher Smith, age 60, Board Member and Chief Executive Officer. Mr. Smith was appointed Chief Executive Officer and a director in August 2022. Prior to joining NeoGenomics, from 2019 to 2022, Mr. Smith served as Chief Executive Officer of Ortho Clinical Diagnostics (“Ortho Clinical”). Under his leadership, Ortho Clinical raised $1.45 billion in funding for a 2021 initial public offering and achieved accelerated revenue growth while simultaneously improving profitability. Mr. Smith successfully guided the company through a combination with Quidel that closed in May 2022. Prior to Ortho Clinical, from 2004 to 2018, Mr. Smith served in key executive leadership positions, including CEO of Cochlear Limited (“Cochlear”), a global market leader in implantable hearing

9

| NeoGenomics, Inc. | 8 | 2024 Proxy Statement | ||||||

solutions. Having initially joined Cochlear as President of Cochlear Americas in 2004, Mr. Smith helped grow division revenue from $80 million to over $400 million before being named CEO in 2015. Before joining Cochlear, Mr. Smith served as a Chief Executive Officer in residence at global private equity firm Warburg Pincus and Global Group President at Gyrus Group Plc., a surgical products company. Prior to that he served in a variety of leadership roles at Abbott, KCI, Prism and Cardinal Health. Since May 2022, Mr. Smith has served as a member of the board of directors at QuidelOrtho, a global provider of innovative in vitro diagnostic technologies. In addition, since March 2022, Mr. Smith has served as Chair of the board of directors of Osler Diagnostics, a UK-based diagnostics company. Mr. Smith has a BS from Texas A&M University.

Skills and Qualifications: Mr. Smith is a dynamic leader with strong cultural values, vast diagnostic industry experience, and an extensive history of proven operating success. Because of Mr. Smith’s extensive industry knowledge and his experience serving on the boards of directors of other public companies, we believe Mr. Smith is well qualified to serve on our Board.

Bruce Crowther, age 71, Board Member and Chair of the Culture and Compensation Committee. Mr. Crowther has served as a director since October 2014. Mr. Crowther served as President and Chief Executive Officer of Northwest Community Healthcare for 23 years, before retiring in 2013. Northwest Community Healthcare is an award-winning hospital offering a complete system of care. Since 2019, Mr. Crowther has been a director of Methode Electronics, Inc., a leading global supplier of custom-engineered solutions. Mr. Crowther has also served on the board of directors of Gray Matter Analytics, Inc., a privately-owned company that provides analytical tools to health systems, since 2018. Mr. Crowther previously served on the board of directors of Wintrust Financial Corporation, a public financial holding company and was previously the chair and a director of the Max McGraw Wildlife Foundation, a not for profit organization committed to conservation education and research. Mr. Crowther has a BS in Biology and an MBA from Virginia Commonwealth University.

Skills and Qualifications: Mr. Crowther has experience in the healthcare industry and a strong knowledge of the hospital market, having served as Chief Executive Officer of a healthcare system for 23 years. We believe Mr. Crowther’s experience in this role allows him to provide insight into how the Company should manage the hospital market. Because of Mr. Crowther’s extensive industry knowledge and his experience serving on the boards of directors of other public companies, we believe Mr. Crowther is well qualified to serve on our Board.

Dr. Alison Hannah, age 62, Board Member and Chair of the Compliance Committee. Dr. Hannah has served as a director since June 2015. Dr. Hannah has over 30 years’ experience in the development of investigational cancer chemotherapies. She currently serves as a consultant to the pharmaceutical industry, working with over 30 companies over 20 years with a focus on molecularly targeted anti-cancer therapy. Dr. Hannah previously served as Senior Vice President and Chief Medical Officer at CytomX Therapeutics, an oncology-focused biopharmaceutical company. Previously, Dr. Hannah worked as Senior Medical Director at SUGEN (working on Sutent and other tyrokine kinase inhibitors) and Quintiles, a global contract research organization. Dr. Hannah has also served on the board of directors of Rigel Pharmaceuticals since 2021. Dr. Hannah specializes in clinical development strategy and has filed over 30 Investigational New Drug applications for new molecular entities and seven successful New Drug Applications (including talazoparib, enzalutamide, defibrotide, carfilzomib, and others). Dr. Hannah received her BA in biochemistry and immunology from Harvard University and her MD from the University of Saint Andrews. She is a member of ASCO, AACR, ASH, ESMO, SITC, and a Fellow with the Royal Society of Medicine.

Skills and Qualifications: Dr. Hannah has significant healthcare knowledge having spent over 20 years as a consultant in the field of oncology drug development and has over 30 years of experience working with biopharmaceutical companies. Dr. Hannah has extensive knowledge of the clinical trials

10

| Proposal 1 | ||||||||

| Dr. Alison Hannah | Age: 63 | Board Member and Chair of the Compliance Committee | ||||||||||||||||||||

Dr. Hannah has served as a director since June 2015. Dr. Hannah has over 30 years’ experience in the development of investigational cancer chemotherapies. She currently serves as a consultant to the pharmaceutical industry, working with over 30 companies over 20 years with a focus on molecularly targeted anti-cancer therapy. From 2020 to 2022, Dr. Hannah served as Senior Vice President and Chief Medical Officer at CytomX Therapeutics, an oncology-focused biopharmaceutical company. Previously, Dr. Hannah worked as Senior Medical Director at SUGEN (working on Sutent and other tyrokine kinase inhibitors) and Quintiles, a global contract research organization. Dr. Hannah has also served on the board of directors of Rigel Pharmaceuticals since 2021. Dr. Hannah specializes in clinical development strategy and has filed over 30 Investigational New Drug applications for new molecular entities and seven successful New Drug Applications (including talazoparib, enzalutamide, defibrotide, carfilzomib, and others). Dr. Hannah received her BA in biochemistry and immunology from Harvard University and her MD from the University of Saint Andrews. She is a member of ASCO, AACR, ASH, ESMO, SITC, and a Fellow with the Royal Society of Medicine. Skills and Qualifications Dr. Hannah has significant healthcare knowledge having spent over 20 years as a consultant in the field of oncology drug development and has over 30 years of experience working with biopharmaceutical companies. Dr. Hannah has extensive knowledge of the clinical trials marketplace, and we believe she will continue to offer valuable guidance on how the Company should position itself to obtain clinical trials diagnostic testing volumes as the Company continues to grow its revenue in that area. Because of this experience and knowledge, we believe Dr. Hannah is well qualified to serve on our Board. | ||||||||||||||||||||

| Stephen Kanovsky | Age: 61 | Board Member and Chair of the Nominating and Corporate Governance Committee | ||||||||||||||||||||

Mr. Kanovsky has served as a director since July 2017. Mr. Kanovsky is Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, where he has served since 2012, which provides medical technologies and solutions to the global healthcare industry and supports customers throughout the world with a broad range of services and systems, from diagnostic imaging and healthcare IT to molecular diagnostics and life sciences. Prior to his service at GE HealthCare, Mr. Kanovsky held numerous legal, compliance, and research roles in several global pharmaceutical companies. Mr. Kanovsky earned his bachelor’s degree from the University of Pennsylvania. He subsequently graduated from Temple University’s School of Pharmacy with a master’s degree in Pharmacology and Temple University’s School of Law with a juris doctorate degree. Mr. Kanovsky also holds an MBA from Saint Joseph’s University’s Haub School of Business. Skills and Qualifications Mr. Kanovsky has over 25 years of legal and compliance experience in the global life sciences and pharmaceutical industry. Through his work as Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, Mr. Kanovsky is able to provide continued knowledge of the life sciences space. He also brings valuable experience to our Board through his prior involvement with Clarient, Inc. (“Clarient”), prior to its acquisition by NeoGenomics in December 2015. Because of Mr. Kanovsky’s extensive legal and compliance background and long-term service to the Board, we believe Mr. Kanovsky is well qualified to serve on our Board. | ||||||||||||||||||||

| NeoGenomics, Inc. | 9 | 2024 Proxy Statement | ||||||

marketplace and we believe she will continue to offer valuable guidance on how the Company should position itself to obtain clinical trials diagnostic testing volumes as the Company continues to grow its revenue in that area. Because of this experience and knowledge, we believe Dr. Hannah is well qualified to serve on our Board.

Stephen Kanovsky, age 60, Board Member and Chair of the Nominating and Corporate Governance Committee. Mr. Kanovsky has served as a director since July 2017. Mr. Kanovsky is Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, which provides medical technologies and solutions to the global healthcare industry and supports customers throughout the world with a broad range of services and systems, from diagnostic imaging and healthcare IT to molecular diagnostics and life sciences. Prior to his service at GE HealthCare, Mr. Kanovsky held numerous legal, compliance, and research roles in several global pharmaceutical companies. Mr. Kanovsky earned his bachelor’s degree from the University of Pennsylvania. He subsequently graduated from Temple University’s School of Pharmacy with a master’s degree in Pharmacology and Temple University’s School of Law with a juris doctorate degree. Mr. Kanovsky also holds an MBA from Saint Joseph’s University’s Haub School of Business.

Skills and Qualifications: Mr. Kanovsky has over 25 years of legal experience in the global life sciences and pharmaceutical industry. Through his work as Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, Mr. Kanovsky is able to provide continued knowledge of the life sciences space. He also brings valuable experience to our Board through his prior involvement with Clarient, Inc. (“Clarient”), prior to its acquisition by NeoGenomics in December 2015. Because of Mr. Kanovsky’s extensive legal and compliance background and long-term service to the Board, we believe Mr. Kanovsky is well qualified to serve on our Board.

Michael Kelly, age 66, Board Member and Chair of the Audit and Finance Committee. Mr. Kelly has served as a director since July 2020 and served as the Board’s Lead Independent Director for the duration of Ms. Tetrault’s service as Chair of the Board and Interim Chief Executive Officer in 2022. Mr. Kelly is a former senior executive of Amgen, Inc. and is currently acting as Founder & President of Sentry Hill Partners, LLC, a global life sciences transformation and management consulting business he founded in 2018. Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions at Amgen Inc. from 2003 to 2017, most recently as Senior Vice President, Global Business Services and Vice President & CFO, International Commercial Operations. Mr. Kelly has also held positions at Biogen, Tanox and Monsanto Life Sciences. Mr. Kelly currently serves as a director for Amicus Therapeutics, DMC Global, Inc., and Prime Medicine, Inc. Mr. Kelly serves on the Council of Advisors and was the former audit committee chair for Direct Relief, a humanitarian aid organization focused on health outcomes and disaster relief. Mr. Kelly holds a BS in business administration from Florida A&M University, concentrating in Finance and Industrial Relations.

Skills and Qualifications: Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions. We believe Mr. Kelly’s extensive experience managing and growing domestic and international organizations, as well as his track record in finance, operations and building differentiated product companies is highly valuable as we continue our long-term growth strategy, and therefore Mr. Kelly is well qualified to serve on our Board. In addition, we believe Mr. Kelly’s extensive knowledge and background in finance qualifies him to serve as a financial expert on the Audit and Finance Committee.

David Perez, age 63, Board Member. Mr. Perez has 40 years of global executive leadership experience, leading the growth and operations of several businesses, growing and scaling organically through research & development and innovation as well as through mergers and acquisitions. In March 2019, he retired from his position as president and CEO of Terumo BCT, a company dedicated to

11

| Proposal 1 | ||||||||

| Michael Kelly | Age: 67 | Board Member and Chair of the Audit and Finance Committee | ||||||||||||||||||||

Mr. Kelly has served as a director since July 2020 and served as the Board’s Lead Independent Director for the duration of Ms. Tetrault’s service as Executive Chair of the Board and Interim Chief Executive Officer in 2022. Mr. Kelly is a former senior executive of Amgen, Inc. ("Amgen") and is currently acting as Founder & President of Sentry Hill Partners, LLC, a global life sciences transformation and management consulting business he founded in 2018. Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions at Amgen from 2003 to 2017, most recently as Senior Vice President, Global Business Services and Vice President & CFO, International Commercial Operations. Mr. Kelly has also held positions at Biogen, Tanox, and Monsanto Life Sciences. Mr. Kelly currently serves as a director for Amicus Therapeutics, DMC Global, Inc., and Prime Medicine, Inc. Mr. Kelly serves on the Council of Advisors and was the former audit committee chair for Direct Relief, a humanitarian aid organization focused on health outcomes and disaster relief. Mr. Kelly holds a BS in business administration from Florida A&M University, concentrating in Finance and Industrial Relations. Skills and Qualifications Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions. We believe Mr. Kelly’s extensive experience managing and growing domestic and international organizations, as well as his track record in finance, operations and building differentiated product companies is highly valuable as we continue our long-term growth strategy, and therefore Mr. Kelly is well qualified to serve on our Board. In addition, we believe Mr. Kelly’s extensive knowledge and background in finance qualifies him to serve as a financial expert on the Audit and Finance Committee. | ||||||||||||||||||||

| David Perez | Age: 64 | Board Member | ||||||||||||||||||||

Mr. Perez has served as a director since November 2022. Mr. Perez has over 40 years of global executive leadership experience, leading the growth and operations of several businesses, growing and scaling organically through research and development and innovation, as well as through mergers and acquisitions. In March 2019, he retired from his position as president and CEO of Terumo BCT, a company dedicated to blood banking, transfusion medicine and cell-based therapies, following a comprehensive two-year succession and transition plan. Mr. Perez currently serves as a director on the following private company boards Laborie Medical Technologies Corp., Advanced Instruments, LLC and MoInlycke Health Care AB. During his nearly 20-year tenure, Mr. Perez guided Terumo BCT through several foreign ownership structures, leveraging his extensive experience leading complex, multinational businesses, and diverse, cross-cultural organizations. Under his leadership as CEO for 18.5 years, the company transformed from a single manufacturing and R&D site to a multi-national biomedical organization with five R&D centers and six manufacturing plants, as he helped drive global revenue growth from $160 million to $1 billion. Mr. Perez holds a BA in Political Science from Texas Tech University. Skills and Qualifications Mr. Perez has 40 years of executive leadership in medical device and health care services, He serves as an independent board member and advisor to several corporations and non-profit organizations. His expertise encompasses growing and scaling highly regulated global businesses organically through R&D and innovation and inorganically through M&A, leading within a variety of foreign, public, and private equity ownership structures, strategic planning, culture and talent development, succession planning, enterprise risk management, operations, compliance, and corporate governance. We believe Mr. Perez’s extensive knowledge and background as a chief executive and director qualifies him to service on our board. | ||||||||||||||||||||

| NeoGenomics, Inc. | 10 | 2024 Proxy Statement | ||||||

blood banking, transfusion medicine and cell-based therapies, following a comprehensive two-year succession and transition plan and now serves as an independent board member for public, private equity and non-profit organizations. During his nearly 20-year tenure, Mr. Perez guided Terumo BCT through several foreign ownership structures, leveraging his extensive experience leading complex, multinational businesses and diverse, cross-cultural organizations. Under his leadership, the company transformed from a single manufacturing and R&D site to a multi-national biomedical organization with five R&D centers and six manufacturing plants, as he helped drive global revenue growth from $160 million to $1 billion. Mr. Perez holds a BA in Political Science from Texas Tech University.

Skills and Qualifications: Mr. Perez has 40 years of executive leadership in medical device and health care services, He serves as an independent board member and advisor to several corporations and non-profit organizations. His expertise encompasses growing and scaling highly regulated global businesses organically through R&D and innovation and inorganically through M&A, leading within a variety of foreign, public and private equity ownership structures, strategic planning, culture and talent development, succession planning, enterprise risk management, operations, compliance, and corporate governance. We believe Mr. Perez’s extensive knowledge and background as a chief executive and director qualifies him to service on our board.

Rachel Stahler, age 47, Board Member. Ms. Stahler has served as a director since May 2020. Ms. Stahler is the Chief Information Officer at Organon, a pharmaceutical company created in 2021 through the spin-off of Merck’s women’s health, legacy brands, and biosimilars businesses. Ms. Stahler has nearly two decades of global technology experience in the pharmaceutical industry. From 2019 to 2020 Ms. Stahler was the Chief Information Officer for Allergan, a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical, device, biologic, surgical, and regenerative medicine products for patients around the world. Prior to Allergan, from 2017 to 2019, Ms. Stahler served as Chief Information and Digital Officer at Syneos Health, a leading CRO / CCO, where she was responsible for designing clinical and commercial systems for customers as an outsourcing leader. Ms. Stahler was also the Chief Information Officer at Optimer Pharmaceuticals and held various senior technology roles at Pfizer. Ms. Stahler holds a BA from the University of Pennsylvania and an MBA from Columbia Business School.

Skills and Qualifications: Ms. Stahler is an experienced Chief Information Officer, having held several executive positions in the pharmaceutical industry, including at Allergan, a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical, device, biologic, surgical, and regenerative medicine products for patients around the world. We believe Ms. Stahler’s experience in designing clinical and commercial systems and prior senior technology roles will continue to enhance the Company’s information technology policies and operations, as well as the composition and governance of the Board, and therefore we believe Ms. Stahler is well qualified to serve on our Board.

12

| Proposal 1 | ||||||||

| Anthony Zook | Age: 63 | Board Member and Chair of the Culture and Compensation Committee | ||||||||||||||||||||

Mr. Zook has served as a director since June 2023. Mr. Zook served as Chief Executive Officer of Innocoll Pharmaceuticals, and prior to that Mr. Zook was Executive Vice President, Commercial Operations of AstraZeneca (AZ) where he held global P&L responsibility for all of AZ's brands and markets. Under Mr. Zook's leadership, AZ commercialized ten brands, each in excess of $1 billion in sales. Mr. Zook was also responsible for MedImmune, AZ's global biologics business. He also chaired the Commercial Investment Board, which identified and approved critical investments company-wide, including investments in plants, markets, and technology. Earlier in his career at AZ, Mr. Zook held various positions including CEO of North America and VP of Sales, where he helped lead the integrations of Astra US, Astra Merck, and Zeneca. Prior to joining AZ, Mr. Zook spent 14 years with Berlex Laboratories in a variety of positions. Skills and Qualifications Mr. Zook has significant experience as a brand and marketing executive with a focus on managing the interface between commercial and research and development aspects of an organization. Mr. Zook has served as a Chief Executive Officer of a large pharmaceutical company with global responsibilities, has significant sales and marketing experience, as well as operational and oncology experience. Because of Mr. Zook's industry knowledge, we believe Mr. Zook is well qualified to serve on our Board. | ||||||||||||||||||||

| Elizabeth Floegel | Age: 48 | Board Member | ||||||||||||||||||||

Ms. Floegel has served as a director since June 2023. Ms. Floegel is Chief Information & Digital Officer of Numotion and manages a significant digital and cybersecurity transformation with the strategic use of data and technology to drive value creation by creating efficient and compliant operations. Before joining Numotion, Ms. Floegel was the Global Vice President of Business Technology at Allergan (now part of Abbvie) where she led the technology portfolio across global commercial, retail, digital products, and marketing. Prior to Allergan, Ms. Floegel was Head of Commercial and Digital Technology for Regeneron Pharmaceuticals and Global Vice President of Commercial Technology for Baxter Healthcare. Ms. Floegel holds an MBA from Benedictine University. Skills and Qualifications Ms. Floegel has a track record for successfully leading technology and organizational transformation in highly matrixed environments. She has extensive experience in cybersecurity, data privacy, automation, compliance technology and digital technology transformation. Because of her experience and knowledge, we believe Ms. Floegel is well qualified to serve on our Board. | ||||||||||||||||||||

| Dr. Neil Gunn | Age: 63 | Board Member and Chair of the Innovation, Pipeline & Technology Committee | ||||||||||||||||||||

Dr. Neil Gunn has served as a director since June 2023. Most recently, Dr. Gunn was the Chief Executive Officer of IDbyDNA, which was acquired by Illumina in 2022. Prior to that, Dr. Gunn was President of Roche Sequencing Solutions ("RSS"), where he grew the organization from early initial concepts to over 900 employees across three continents while integrating nine acquisitions into one with a common vision and strategy. Before RSS, Dr. Gunn was Head of Global Business for Roche Molecular Diagnostics and was responsible of the development and execution of strategic plan that launched over 140 major assay, instrument, and software launches over six years. Dr. Gunn’s earlier roles include Vice President Commercial Operations for CaridianBCT and Vice President of Commercial Operations - Americas for Novartis Diagnostics. Skills and Qualifications Dr. Gunn is a veteran diagnostics senior executive with expertise in company organization to maximize efficiencies with a focus on value generators to drive growth. Dr. Gunn has multi-year executive experience in multinational diagnostic companies and startups. He also has technical expertise in oncology diagnostics, next generation sequencing and other relevant technologies. Because of this experience and knowledge, we believe Dr. Gunn is well qualified to serve on our Board. | ||||||||||||||||||||

| NeoGenomics, Inc. | 11 | 2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

Average Tenure Directors

| Average Age Directors

| % of Diverse Directors

| ||||||||||||||

| 3.5 years | 62 years | 56% | ||||||||||||

Board Diversity Matrix (as of April 8, 2024) | ||||||||||||||

| Total Number of Directors | 9 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 3 | 6 | 0 | 0 | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||||||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||||||||

| Asian | 0 | 0 | 0 | 0 | ||||||||||

| Hispanic or Latinx | 0 | 1 | 0 | 0 | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||

| White | 3 | 4 | 0 | 0 | ||||||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||||||

| LGBTQ+ | 0 | 0 | 0 | 0 | ||||||||||

| Did not Disclose Demographic Background | 0 | 0 | 0 | 0 | ||||||||||

| 12 | ||||||||

|

|

Female |

Male |

Non-Binary | Did Not Disclose Gender | ||||

| Part I: Gender Identity | ||||||||

| Directors | 3 | 5 | 0 | 0 | ||||

| Part II: Demographic Background | ||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||

| Asian | 0 | 0 | 0 | 0 | ||||

| Hispanic or Latinx | 0 | 1 | 0 | 0 | ||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

| White | 3 | 3 | 0 | 0 | ||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

| LGBTQ+ | 0 | 0 | 0 | 0 | ||||

| Did not Disclose Demographic Background | 0 | 0 | 0 | 0 | ||||

13

| Proposal 1 | ||||||||||||||||||||||||||||||||

| Board Strategic Competencies Matrix | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Competencies / Attributes | Lynn Tetrault | Dr. Alison Hannah | Stephen Kanovsky | Michael Kelly | David Perez | Dr. Neil Gunn |

| Chris Smith | Tony Zook | Elizabeth Floegel | ||||||||||||||||||||||||||||||||||||||||||||||

| Financial (Reporting, Auditing, Internal Controls) | X | X | X | X | X |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Strategy/Business Development / M&A | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||||||||||||

| Human Resources / Organizational Development | X | X | X | X |

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Legal / Governance / Business Conduct | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales / Marketing | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk Management | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||||||||||||||

| X | X | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Research & Development | X | X | X | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| X | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sustainability | X | X | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Public Policy / Regulatory Affairs | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Director Name |

| Audit and Committee |

| Compliance Committee |

| Culture and Compensation Committee |

| Nominating and Corporate Governance Committee | ||||||||

Lynn Tetrault (non-executive Chair of the Board) |

|

|

|

|

| X |

| X | ||||||||

| Bruce Crowther |

| X |

|

|

| Chair |

|

| ||||||||

| David Daly (1) |

|

|

| X |

| X |

|

| ||||||||

| Dr. Alison Hannah |

|

|

| Chair |

|

|

| X | ||||||||

| Stephen Kanovsky |

|

|

| X |

|

|

| Chair | ||||||||

| Michael Kelly |

| Chair |

|

|

| X |

|

| ||||||||

| David Perez |

| X |

| X |

|

|

|

| ||||||||

| Rachel Stahler |

| X |

|

|

|

|

| X | ||||||||

| Number of Meetings Held in 2022 |

| 8 |

| 4 |

| 8 |

| 6 | ||||||||

| Director Name | Audit and Finance Committee | Compliance Committee | Culture and Compensation Committee | Nominating and Corporate Governance Committee | Innovation, Pipeline & Technology Committee | ||||||||||||

| Lynn Tetrault (non-executive Chair of the Board) | X | X | |||||||||||||||

Bruce Crowther(1) | X | X | |||||||||||||||

| Dr. Alison Hannah | Chair | X | X | ||||||||||||||

| Stephen Kanovsky | X | Chair | |||||||||||||||

| Michael Kelly | Chair | X | |||||||||||||||

| David Perez | X | X | X | ||||||||||||||

Tony Zook(2) | X | Chair | X | ||||||||||||||

| Elizabeth Floegel | X | X | |||||||||||||||

| Dr. Neil Gunn | X | X | Chair | ||||||||||||||

| Number of Meetings Held in 2023 | 8 | 4 | 8 | 6 | 0(3) | ||||||||||||

| NeoGenomics, Inc. |

| 2024 Proxy Statement | ||||||

14

| Proposal 1 | ||||||||

15

2023 to advise the Culture and Compensation Committee on peer development, market practices, industry trends, investor views, and benchmark compensation data.data related to executive officer and director compensation. In addition, WTW reviewed and provided the Culture and Compensation Committee with an independent perspective of management recommendations. These duties were consistent with those performed in prior years. For the year ending December 31, 2022,2023, aggregate fees for WTW’s consulting services provided to the Culture and Compensation Committee were approximately $440,000. Approximately $270,000$547,000, of this aggregate amount which approximately $384,000 was related to review of executive compensation.

| NeoGenomics, Inc. | 14 | 2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

16

Stockholder Recommendations for Board Candidates

The Board will consider qualified candidates for director that are recommended and properly submitted by stockholders in accordance with our Amended and Restated Bylaws (“Bylaws”). Any stockholder may submit in writing a candidate for consideration for each stockholder meeting at which directors are to be elected by no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the anniversary date of the prior year’s annual meeting, except that if the annual meeting is set for a date that is not within 30 days of such anniversary date, we must receive the notice no later than the close of business on the tenth day following the day on which the date of the annual meeting is first disclosed in a public announcement. Any stockholder recommendations for consideration by

The Committee will evaluate any such candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members, assuming that appropriate biographical and background material is provided forconsideration of director candidates recommended by stockholders from other sources. Such recommendations should be

| NeoGenomics, Inc. | 15 | 2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

candidate, as well as any other information required by our Amended and Restated Bylaws. (the "Bylaws").

The Corporate Secretary's Office generally does not forward communications from stockholders that are not related to the duties and responsibilities of the Board, including junk mail, service complaints, employment issues, business suggestions, job inquiries, opinion surveys, and business solicitations.

17

| NeoGenomics, Inc. | 16 | 2024 Proxy Statement | ||||||

TO OUR NAMED EXECUTIVE OFFICERS

this Proposal 2.

18

| NeoGenomics, Inc. | 17 | 2024 Proxy Statement | ||||||

The Board recommends that stockholders approve the 2023 Equity Incentive Plan. The purposes of the 2023 Equity Incentive Plan are to enhance our ability to attract and retain highly qualified officers, non-employee directors, key employees and consultants, and to motivate eligible service providers to serve the Company and to expend maximum effort to improve our business results and earnings, by providing to eligible service providers anits subsidiaries the opportunity to acquire or increase a direct proprietaryan ownership interest in our operations and future success of the company.

The Board seeks approval for an aggregate share reserve of (a) 3,975,000 shares under the 2023 Equity Incentive Plan and (b) any shares which remain available for issuance under the Prior Plan as of the Effective Date, initially equating to approximately 6.93% and 5.83% percent of our weighted-average common shares outstanding on a basic and diluted basis, respectively, as of March 27, 2023 (the “Record Date”). When including the options and stock awards outstanding, the aggregate share reserve equates to 10.48% and 8.81% of our weighted-average common shares outstanding on a basic and diluted basis, respectively, as of the Record Date. 3,975,000 shares will be available for issuance under the 2023 Equity Incentive Plan as Incentive Stock Options.

The Board considered various factors when determining the number of shares to ask stockholders to approve under the 2023 Equity Incentive Plan, including the replacement of the Prior Plan, “overhang”, “burn rate”, dilution, historical grant practices and our forecasted equity award grants.

At December 31, 2022, the Equity Incentive Plan had 4,868,198 shares remaining available for future issuance. In addition, a total of 4,529,837 options and stock awards in aggregate were outstanding, comprised of the following:

3,271,004 stock options (weighted average exercise price of $17.67, and weighted average remaining term of 2.0 years)

1,258,833 stock awards

Over the past three years, the Company has used options andthrough the purchase of Company common stock awards judiciously, withat a value-adjusted burn rate average of approximately 2.09% (of weighted average basic common shares outstanding) as compared to the Health Care Equipment & Services industry benchmark of 3.76%.

19

The Company has granted awards as follows:

| Fiscal Year |

| Stock Options Granted |

| Stock Awards Granted | ||||

2022 |

| 4,494,333 |

| 2,865,727 | ||||

2021 |

| 1,232,056 |

| 936,648 | ||||

2020 |

| 845,120 |

| 149,012 | ||||

Based on its review, the Culture and Compensation Committee recommended the reserve of (a) 3,975,000 shares under the 2023 Equity Incentive Plan and (b) any shares which remain available for issuance under the Prior Plan as of the Effective Date, to ensure the 2023 Equity Incentive Plan has an adequate number of shares available. Accordingly, the Board approved and is recommending that the Company’s stockholders approve a share reservethe Fourth Amendment of (a) 3,975,000the ESPP (the “ESPP Amendment”) to increase the number of shares under the 2023 Equity Incentive Plan and (b) any shares which remain availableof common stock reserved for issuance under the Prior Plan asESPP by 1,000,000 shares to 3,500,000 shares. As of March 31, 2024, there were 2,500,000 shares of the Effective DateCompany’s common stock reserved under the 2023 Equity Incentive Plan, with 3,975,000ESPP, of which approximately 315,000 shares were available for issuancefuture purchases. Accordingly, if the ESPP Amendment is approved, approximately 1,315,000 shares would be available for future purchases.

amended by the ESPP Amendment continues to provide essentially the same substantive terms and provisions as the existing ESPP.

The material featuresESPP, to make all determinations regarding the ESPP, including eligibility, and otherwise administer the ESPP. Our Board has delegated administration of the 2023 Equity Incentive Plan are summarized below. The summary is qualified in its entirety by referenceESPP to the specific provisions of the 2023 Equity Incentive Plan, the full text of which is set forth as Annex A to this Proxy Statement.

Description of the Plan

Corporate Governance Aspects of the Plan

The 2023 Equity Incentive Plan has been designed to include a number of provisions that promote best practices by reinforcing the alignment between equity compensation arrangements for eligible service providers and stockholders’ interests. These provisions include, but are not limited to, the following:

|

|

|

|

|

|

20

|

|

|

|

Administration

The 2023 Equity Incentive Plan is administered by the Culture and Compensation Committee. SubjectIn this summary, we use the term “our Board” to refer to the express provisionsadministrator of the 2023 Equity Incentive Plan,ESPP.

Summary3,500,000 shares of Award Terms and Conditions

Awards under the 2023 Equity Incentive Plan may include nonqualified and incentive stock options, stock appreciation rights, restricted shares, restricted stock units and other stock-based awards. Any of these awards may (but need not) be made as performance incentives to reward attainment of performance goals.

Stock Options. The Culture and Compensation Committee may grant to a 2023 Equity Incentive Plan participant options to purchase our common stock that qualifywill be reserved under the amended ESPP, of which approximately 1,315,000 shares would be available for future purchases under the ESPP, subject to adjustment in the event of any significant change in our capitalization, such as incentivea stock options for purposessplit, a combination or exchange of Code Section 422, options that do not qualify as incentive stock options,shares, or a combination thereof. The terms and conditions of stock dividend or other distribution. If any option grants, includingunder the quantity, exercise price, vesting periods and other conditions on exercise will be determined byESPP is terminated without having been exercised, the Committee and will be reflected in a written award agreement.

The exercise price of each option (except those that constitute substitute awards) will be determined by the Culture and Compensation Committee, but will be at least the fair market value of a shareshares of common stock onsubject to such option will again become available under the date the stock option is granted; provided, however,ESPP.

| NeoGenomics, Inc. | 18 | 2024 Proxy Statement | ||||||

| Proposal 3 | ||||||||

Stock options must be exercised within a period fixed by the Culture and Compensation Committee thatas of March 28, 2024, was $15.72 per share. Participants may not exceed 10 yearswithdraw from the date of grant, except thatparticipation in the case of incentive stock options grantedESPP at any time during an offering period and will be paid their accrued payroll deductions that have not yet been used to a holder of more than 10% of the total combined voting power of all classes of our stock on the date of grant, the exercise period may not exceed five years. The 2023 Equity Incentive Plan

21

provides for earlier termination of stock options upon the participant’s termination of service, unless extended by the Culture and Compensation Committee, but in no event may the options be exercised after the scheduled expiration date of the options.

At the Culture and Compensation Committee’s discretion, payment forpurchase shares of common stock onstock. Participation ends automatically upon termination of employment with us.

Stock Appreciation Rights. The Culture and Compensation Committee may grant to a 2023 Equity Incentive Plan participant an award of stock appreciation rights, which entitlesloss realized by the participant to receive,on the sale of the shares. Any such additional gain or loss will be taxed as capital gain or loss, long or short, depending on how long the participant held the shares.

The exercise price for a stock appreciation right will be determined by the Culture and Compensation Committee in its discretion, but may not be less than 100%first day of the fair market value of one share of our common stock on the date when the stock appreciation right is granted. Stock appreciation rights must be exercised within a period fixed by the Culture and Compensation Committee that may not exceed 10 years from the date of grant. Upon exercise of a stock appreciation right, payment may be made in cash, shares of our stockoffering period), or a combination of cash and stock.

Restricted Stock. The Culture and Compensation Committee may grant to a 2023 Equity Incentive Plan participant shares of common stock subject to specified restrictions, which we refer to as restricted shares. Restricted shares are subject to forfeiture if the participant does not meet certain conditions such as continued employment over a specified forfeiture period or the attainment of specified performance targets over the forfeiture period. The terms and conditions of restricted share awards are determined by the Culture and Compensation Committee and will be reflected in a written award agreement.

Restricted Stock Units. The Culture and Compensation Committee may grant to a 2023 Equity Incentive Plan participant restricted stock units, which represent the right to earn one share of common stock (or its cash equivalent) upon a participant’s satisfaction of specified terms and conditions. The terms and conditions of restricted stock units are determined by the Culture and Compensation Committee and will be reflected in a written award agreement.

Other Stock-Based Awards. The Culture and Compensation Committee may grant to a 2023 Equity Incentive Plan participant equity-based or equity-related awards, referred to as other stock-based awards, other than options, stock appreciation rights, restricted shares, or restricted stock units. Such other stock-based awards will be subject to terms and conditions as the Culture and Compensation Committee may determine.

Effect of a Change in Control or Similar Corporate Transactions

The Culture and Compensation Committee may provide in any award agreement, or in the event of a change in control may take such actions as it deems appropriate to provide, for any of the following:

acceleration of the vesting or settlement of any such award;

the cancellation of any award in exchange for the value of any vested portion thereof;

22

the issuance of substitute awards or the assumption or replacement of awards;

the termination of all awards not exercised after providing written notice to participants that for a period of at least ten days such awards are exercisable;

the treatment of awards in the manner set forth in the agreement pursuant to which the change in control is consummated.

Eligibility and Limitation on Awards

The Culture and Compensation Committee may grant awards under the 2023 Equity Incentive Plan to any employee, independent director or consultant of ours or any of our participating subsidiaries. While the selection of participants is within the discretion of the Culture and Compensation Committee, it is currently expected that participants will be primarily officers and key senior level employees, as well as our independent directors. As of the date of the filing of this Proxy Statement, all of our approximately 2,100 employees, and each of our seven independent directors, are eligible to participate in the 2023 Equity Incentive Plan.

An option will constitute an incentive stock option only (i) if the participant is an employee; (ii) to the extent specifically provided in the award agreement; and (iii) to the extent that the aggregate fair market value (determined at the time the option is granted) of the shares of all incentive stock options held by the participant that become exercisable during any calendar year does not exceed $100,000.

Shares Subject to the 2023 Equity Incentive Plan

The number of shares of our common stock reserved for issuance for awards under the 2023 Equity Incentive Plan, subject to stockholder approval, is 3,975,000. 3,975,000 of such shares of common stock available for issuance under the 2023 Equity Incentive Plan shall be available for issuance as incentive stock options. These shares would be additive to any shares which remain available for issuance under the Prior Plan as of the Effective Date.

Shares of common stock underlying awards granted under the 2023 Equity Incentive Plan that expire or are forfeited or terminated for any reason (as a result, for example, of the lapse of stock options or forfeiture of restricted shares), as well as any shares underlying an award that is settled in cash rather than stock, will be available for future grants under the 2023 Equity Incentive Plan. In addition, shares of stock that are surrendered to or withheld by us in payment or satisfaction of the exercise price of an award or any tax withholding obligation with respect to an award will be available for future grants. Shares to be issued under the 2023 Equity Incentive Plan will be authorized but unissued shares of common stock or shares of stock reacquired by us.

Anti-Dilution Protections

In the event of a change in the outstanding shares of our common stock, without the receipt by us of consideration, by reason of a stock dividend, stock split, reverse stock split or distribution, recapitalization, merger, reorganization, reclassification, consolidation, split-up, spin-off, combination of shares, exchange of shares or other similar event, the Culture and Compensation Committee will make appropriate and equitable adjustments to (a) the number and kind of shares of stock available under the 2023 Equity Incentive Plan, (b) the number and kind of shares of stock subject to outstanding 2023 Equity Incentive Plan awards, (c) the per-share exercise or other purchase price under any outstanding 2023 Equity Incentive Plan award and (d) the annual award or other maximum award limits applicable under the 2023 Equity Incentive Plan.

23

Clawback Provisions

The 2023 Equity Incentive Plan provides that in the event of a restatement of our financials due to material noncompliance with any financial reporting requirements under the law, a participant will be required to reimburse us for any amounts earned or payable in connection with an award under the 2023 Equity Incentive Plan to the extent required by law and any applicable Company policies.

No Repricings of Options or SARs

The 2023 Equity Incentive Plan prohibits the repricing of stock options and stock appreciation rights without the approval of our stockholders. This provision applies to both direct repricings (lowering the exercise price or strike price of a stock option or stock appreciation right) as well as indirect repricings (canceling an outstanding stock option or stock appreciation right and granting a replacement stock option or stock appreciation right with a lower exercise price or strike price or exchange for cash or other forms of awards).

Amendment and Termination

The Board may suspend, terminate, or amend the 2023 Equity Incentive Plan, provided that any amendment to the 2023 Equity Incentive Plan will be subject to the approval of our stockholders to the extent required by applicable law.

In addition, no suspension, termination or amendment of the 2023 Equity Incentive Plan may terminate a participant’s existing award or materially and adversely affect a participant’s rights under such award without the participant’s consent. However, these provisions do not limit the board’s authority to amend or revise the 2023 Equity Incentive Plan to comply with applicable laws or governmental regulations.

Federal Income Tax Consequences

THE FEDERAL INCOME TAX CONSEQUENCES OF THE ISSUANCE AND EXERCISE OF AWARDS UNDER THE PLAN GENERALLY ARE AS DESCRIBED BELOW. THE FOLLOWING INFORMATION IS ONLY A SUMMARY OF THE TAX CONSEQUENCES OF THE AWARDS AND IS NOT INTENDED TO COVER ALL TAX CONSEQUENCES NOR IS IT INTENDED TO BE USED BY ANY TAXPAYER TO AVOID PENALTIES WHICH MAY BE IMPOSED.WE ENCOURAGE PARTICIPANTS TO CONSULT WITH THEIR OWN TAX ADVISORS WITH RESPECT TO THE TAX CONSEQUENCES INHERENT IN THE OWNERSHIP OR EXERCISE OF THEIR AWARDS, AND THE OWNERSHIP AND DISPOSITION OF ANY UNDERLYING SECURITIES. TAX CONSEQUENCES FOR ANY PARTICULAR INDIVIDUAL OR UNDER STATE OR NON-U.S. TAX LAWS MAY BE DIFFERENT.

Incentive Stock Options. A participant who is granted an incentive stock option generally will not recognize any taxable income for federal income tax purposes on either the grant or exercise of the incentive stock option (except for alternative minimum tax purposes, as described below). If the participant disposes of the shares purchased pursuant to the incentive stock option more than two years after the date of grant and more than one year after the exercise of the option by the participant, (a) the participant will recognize long-term capital gain or loss, as the case may be, equal to the difference between the selling price and the exercise price; and (b) we will not be entitled to a deduction with respect to the shares of stock so issued. If the two-year holding period requirements are not met, any gain realized upon disposition will be taxed as ordinary income to the extent of the lesser of (1) the excess of the fair market value of the shares at the time of exercisesale of the shares or on the date of death over the exercise price and (2)paid for the gain onshares by the sale. Also in that case, we will be entitled to a deductionparticipant. Except in the yearcase of disposition in ana transfer as a result of death, the amount equal to theof ordinary income recognized by the participant.participant will be added to the participant’s basis in such shares. Any additional gain realized upon the sale in excess of such basis will be taxed as short-term ora long-term capital gain depending upon the actual holding period for

24

| NeoGenomics, Inc. | 19 | 2024 Proxy Statement | ||||||

the stock. A sale for less than the exercise price results in a capital loss.

| Proposal 3 | ||||||||

Nonqualified Stock Options. A participant who is granted a nonqualified stock option under the 2023 Equity Incentive Plan generallyCompany will not recognizereceive any income for federal income tax purposes on the grantdeduction as a result of the option. Generally, on the exercise of the option, the participant will recognize taxable ordinary income equal to the excess of the fair market value of theissuing shares on the exercise date over the option price for the shares. We generally will be entitled to a deduction on the date of exercise in an amount equal to the ordinary income recognized by the participant. Upon disposition of the shares purchased pursuant to the stock option, the participant will recognize long-term or short-term capital gain or loss, as the case may be, equal to the difference between the amount realized on such disposition and the basis for such shares, which basis includes the amount previously recognized by the participant as ordinary income.

Stock Appreciation Rights. A participant who is granted stock appreciation rights generally will not recognize any taxable income on the receipt of the award. Upon the exercise of a stock appreciation right, (a) the participant will recognize ordinary income equal to the amount received (the increase in the fair market value of one share of our stock from the date of grant of the award to the date of exercise multiplied by the number of sharesESPP except, subject to the award), and (b) we will be entitled to a deduction on the date of exercise in an amount equal to the ordinary income recognized by the participant.

Restricted Stock. A participant generally will not recognize any taxable income on the grant date of an award of restricted shares, but will be taxed at ordinary income rates on the fair market value of any restricted shares as of the date that the restrictions lapse, unless the participant, within 30 days after transfer of such restricted shares to the participant, elects under Code Section 83(b) to include in income the fair market value of the restricted shares as of the date of such transfer. We generally will be entitled to a corresponding deduction. Any disposition of shares after the restrictions lapse will be subject to the regular rules governing long-term and short-term capital gains and losses, with the basis for this purpose equal to the fair market value of the shares at the end of the restricted period (or on the date of the transfer of the restricted shares, if the employee elects to be taxed on the fair market value upon such transfer). To the extent dividends are payable during the restricted periodlimitations under the applicable award agreement, any such dividends will be taxable to the participant at ordinary income tax rates and will be deductible by us unless the participant has elected to be taxed on the fair market value of the restricted shares upon transfer, in which case they will thereafter be taxable to the participant as dividends and will not be deductible by us.

Restricted Stock Units. A participant generally will not recognize any taxable income on the grant date of an award of restricted stock units, but will be taxed at ordinary income rates on the fair market value of the restricted stock units as of the vesting or settlement date.

Internal Revenue Code, Section 162(m). Because we are a public company, special rules limit the deductibility of compensation paid to any “covered employee”. A covered employee is generally defined as the principal executive officer or principal financial officer at any time during the year, or any individual acting in such a capacity, and the three other most highly compensated executive officers. An employee that was considered a covered employee after 2016 will always be considered a covered employee even if the employee is no longer the principal executive officer, principal financial officer, or one of the three other most highly compensated executive officers during the applicable year. Under Code Section 162(m), the annual compensation paid to each of these executives may not be deductible to the extent that it exceeds $1 million.

25

New Plan Benefits

Because awards undera participant is required to include as ordinary income amounts arising upon the 2023 Equity Incentive Plan are discretionary, awards are generally not determinable at this time.

sale or disposition of such shares as discussed above.

stockholders.

26

| NeoGenomics, Inc. | 20 | 2024 Proxy Statement | ||||||

2024.

| 2022 |

| 2021 | ||||||||

Audit fees | $ | 1,949,493 |

| $ | 3,162,128 | |||||

Audit related fees | 233,102 |

| 275,168 | |||||||

Tax fees | — |

| — | |||||||

All other fees | 4,140 |

| 3,790 | |||||||

|

|

|

| |||||||

Total | $ | 2,186,735 |

| $ | 3,441,086 | |||||

|

|

|

| |||||||

2022.

| 2023 ($) | 2022 ($) | ||||||||||||||||

| Audit fees | 1,772,689 | 1,949,493 | |||||||||||||||

| Audit related fees | 276,737 | 233,102 | |||||||||||||||

| Tax fees | 58,261 | — | |||||||||||||||

| All other fees | 4,140 | 4,140 | |||||||||||||||

| Total | 2,111,827 | 2,186,735 | |||||||||||||||

SEC registration statement services.

27

The Audit and Finance Committee’s policy is to pre-approve all audit and non-audit services provided by the independent registered public accounting firm, including the estimated fees and other terms of any such engagement. During 2022,2023, the Audit and Finance Committee pre-approved all audit and permitted non-audit services provided by Deloitte & Touche LLP.

| NeoGenomics, Inc. | 21 | 2024 Proxy Statement | ||||||

| Proposal 4 | ||||||||

MEMBERS OF THE AUDIT AND FINANCE COMMITTEE

Michael Kelly (Chair)

Bruce Crowther

David Perez

Rachel Stahler

28

| MEMBERS OF THE AUDIT AND FINANCE COMMITTEE | ||

| Michael Kelly (Chair) | ||

| Bruce Crowther | ||

| Elizabeth Floegel | ||

| David Perez | ||

| Tony Zook | ||

Vote Required for Approval

this Proposal 4.

29

EXECUTIVE OFFICERS

| NeoGenomics, Inc. | 22 | 2024 Proxy Statement | ||||||

| Executive Officer | Age | Current Position | |||||||||

Christopher Smith | 61 | Director and Chief Executive Officer | |||||||||

Jeffrey Sherman | 58 | Chief Financial Officer | |||||||||

| Gregory Aunan | 54 | ||||||||||

| Chief Accounting Officer | ||||||||||

Alicia Olivo(1) | 40 | EVP, General Counsel & Business Development | |||||||||

| |||||||||||

Melody Harris | 58 | President, Enterprise Operations | |||||||||

Warren Stone | 51 | President, Clinical Services | |||||||||

Vishal Sikri | 48 | President, Advanced Diagnostics | |||||||||

| |||||||||||

|

|

|

|

|

|

|

30

Cynthia Dieter

Chief Accounting Officer

Ms. Dieter

of Iowa.

& Business Development

| NeoGenomics, Inc. | 23 | 2024 Proxy Statement | ||||||

| Executive Officers | ||||||||

31

Ortho Clinical Diagnostics, a leading global provider of in-vitro diagnostics solutions to the clinical laboratory and transfusion medicine communities. Prior to Ortho Clinical, from 1992 to 2020, Mr. Stone served in various roles, at MillisporeSigma (formerly EMDMillipore), the Life Science business of Merck KGaA Darmstadt, Germany, and a leading provider of laboratory materials, technologies and services to scientists and engineers in the U.S., Canada and Latin America. His roles included Senior Vice President, Research Commercial Americas (Life Science Division) from 2016 to 2020, and Vice President of Sales North America (Life Science division) from 2014 to 2015. Prior to that role, Mr. Stone served as General Manager and Vice President of Lab Essentials based in Germany, where he led the global transformation to Advanced Analytics from 2012 to 2014.

Mr. Stone holds an MBA from Suffolk University.

Dr. Shashikant Kulkarni

Chief Scientific Officer and Executive Vice President of Research & Development

Dr. Kulkarni joined NeoGenomics in March 2022 as Executive Vice President for Research & Development and Chief Scientific Officer. In June 2022, Dr. Kulkarni was appointed as Chief Scientific Officer and President, Laboratory Operations. Subsequently, in January 2023, he was appointed as Chief Scientific Officer and Executive Vice President of Research & Development. Dr. Kulkarni served as Chief Scientific Officer and Senior Vice President of Innovation and Emerging Business at Baylor Genetics from 2016 to 2022. He also served as a tenured professor and Vice Chairman for Research, Department of Molecular and Human Genetics at Baylor College of Medicine, Houston, Texas. At Baylor, he led an extensive clinical and translational research team, delivering top-quality clinical genomics and multi-omics tools. Working in collaboration with many professional societies, he has been a pioneer in creating best practices guidelines in Clinical Next-Generation Sequencing for somatic cancer, constitutional genomics, bioinformatics, and whole-genome sequencing. Dr. Kulkarni is considered an expert and key opinion leader in cancer genomics with a focus on the application of genomic and multi-omic technologies. Dr. Kulkarni has served as an expert panelist on several preeminent regulatory agencies such as FDA, CDC, CMS, and NIH. He is the Editor-in-Chief of Cancer Genetics Journal and co-edited a book titled Clinical Genomics - A Guide to Clinical Next-Generation Sequencing. Additionally, he has published extensively in peer-reviewed articles and numerous well-known journals.

Dr. Kulkarni completed his Clinical Fellowship at Harvard Medical School and his translational genomics training at Imperial College in London, UK, and at All India Institute of Medical Sciences. He is an American Board of Medical Genetics and Genomics board-certified medical geneticist with dual certifications in Clinical Molecular Genetics and Genomics and Clinical Cytogenetics and Genomics. He is also a fellow of the American College of Medical Genetics and genomics and holds an executive MBA.

32

| NeoGenomics, Inc. | 24 | 2024 Proxy Statement | ||||||

Compensation of Independent Directors

•Directors serving as Audit and Finance Committee members received annual compensation of $10,000. The Director serving as chair of the Audit and Finance Committee received annual compensation of $20,000.

•Directors serving as Culture and Compensation Committee members received annual compensation of $7,500. The Director serving as chair of the Culture and Compensation Committee received annual compensation of $15,000.

•Directors serving as Compliance Committee members received annual compensation of $5,000. The Director serving as chair of the Compliance Committee received annual compensation of $10,000.

•Directors serving as Nominating and Corporate Governance Committee members received annual compensation of $5,000. The Director serving as chair of the Nominating and Corporate Governance Committee received annual compensation of $10,000.

The Board has the discretion to grant equity awards to

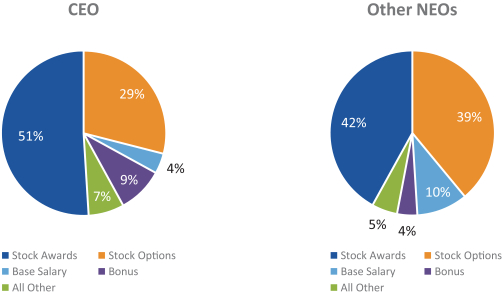

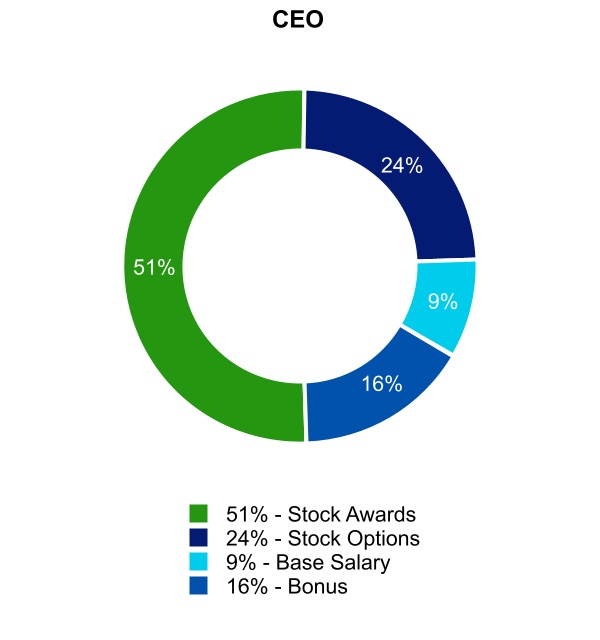

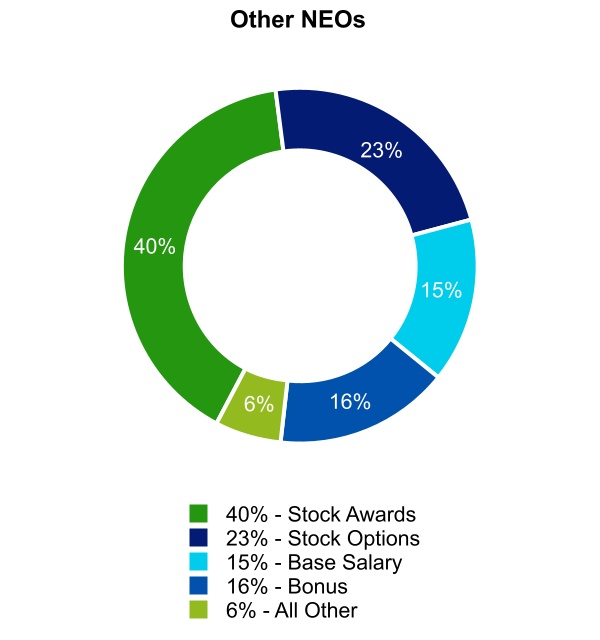

2024.